This content is protected against AI scraping.

How much money could you have for tax lien investing if you weren’t paying off your credit card debt?

This article is from my friend Richard Geller, a wealth building and debt elimination expert. I decided to include this in my blog because it’s information that some people need right now. It may not be for you, but maybe you know someone who needs this information. I get a lot of e-mails from people who are in a lot of debt right now and they want to know if tax lien investing can help them get out of debt. My advice is get out of debt and start investing in tax liens at the same time if you possibly can – that way when you are debt free you’ll have something to show for it.

With Richard’s information you can get out from under the debt monster faster and pay less of your money to the bank. To learn more join Richard and I for a free webinar this Wednesday, January 12, 2011 at 9pm Eastern. You can sign up at

?http://www.mortgagereliefformula.com/cmd.php?Clk=4078609

Guest Article from Richard Geller:

I have taught thousands of people how to get out of credit card debt and start a new life. I?ve had students who owed as little as $3,000 or as much as (on one occasion I recall) $800,000.

In this article I want to show you a new strategy for settling debts, and show you why you should settle them, and times when that is not appropriate.??

It?s not about big screen televisions and luxury vacations

The average is probably around $60,000 and maybe 80% of folks that have gotten my materials have been in that area in terms of debt.

And they?ve carried that debt for many years, typically.

?The mainstream media likes to talk about irresponsible consumers snarfing up bigscreen televisions and taking luxury vacations they cannot afford.?

This is the minority of the problems that I see. I mostly see folks who are earning less than they are spending. Things were okay for awhile. Perhaps they speculated a bit in real estate at the wrong time. They got upside down. Their living expenses are modest. But today?s horrible economy has resulted in their SPENDING more than they make, just by a nose.

But this nose adds up and over the years they accumulate more and more and more card debt, just to get by. Just to live.

An occasional out of pocket medical expense. Or a period out of work entirely. And before you know it, you?ve been carrying around $60,000 in card debt for several years.

?The average person has seven credit cards and over $11,000 in debt. But most of the people I work with have $60,000 in debt. Some have $300,000 or more.

?The average person has seven credit cards and over $11,000 in debt. But most of the people I work with have $60,000 in debt. Some have $300,000 or more.

?In this article I will talk about what you can do about that card debt.

?Photo courtesy of http://www.flickr.com/photos/andresrueda/

Three ways to get out of debt

There are three strategies to getting out of debt.

One is to pay the debts off.

Two is to just pay minimum payments and continue carrying the debt (or adding to it) basically ?forever?.

If you are living on credit, you are not free. And it’s a shame, because it’s pretty easy to escape debt entirely and live free the way we were intended. You can save the money you are now paying to the banks. Photo courtesy of http://www.flickr.com/photos/41636321@N00/

If you are living on credit, you are not free. And it’s a shame, because it’s pretty easy to escape debt entirely and live free the way we were intended. You can save the money you are now paying to the banks. Photo courtesy of http://www.flickr.com/photos/41636321@N00/

Three is to settle your debts, which you can do inside of a bankruptcy process, or without bankruptcy.

Let?s talk about each one.

?

Photo courtesy of http://www.flickr.com/photos/41636321@N00/

?

Paying off credit card debt may not be the answer

I?ve been an occasional listener and viewer of Dave Ramsey and I like him. His answer to folks is to do two things.

First, destroy all your credit cards. Use cash or debit cards. But step one is to get rid of ALL cards.

Step two is to basically eat rice and beans, scrimp and save, never eat out, don?t live, and apply the resulting surplus to your card debt until it?s paid off.

?If you can pay off your cards, do so. Or if you can’t, then settle your debts.

?Photo courtesy of http://www.flickr.com/photos/pumpkinjuice/

?

If you can do this, fine. But many folks can?t do it. And if they do, they spend years sacrificing everything and don?t pay the debts off even then. That?s why I don?t like this approach.

What Dave doesn?t appreciate is that

?The credit card money you borrowed was created out of thin air

You are paying back cards with the sweat of your brow. But the banks created this money out of thin air.

Ever wondered why Wall Street has these ginormous bonuses? It?s because they borrow money and invest it risk-free. This borrowed money is also printed out of thin air.

So here?s the equation. You borrow and money is created with zero effort, zero labor. And you pay it back one hard earned dollar at a time, over many years, at great sacrifice.

?See something wrong with this picture? I do. The money you borrowed into existence (the banks created out of thin air) came to you at zero cost, yet you pay it back at horrible cost, like a slave would.

This money that the banks create out of thin air ? it comes out the hides of savers and investors. It comes out of the IRA or 401K money that people have put aside.

? ??

??

This year the Federal Reserve is going to print around $2 trillion out of thin air. That?s $6700 for you, me, your son, your daughter, my son, my daughter?every living person in the United States!

?What happens to someone?s savings of, say, $100,000, when $6800 per person is magically printed? The value of that $100,000 savings is REDUCED by $6800.

?There is no way anyone gets something for nothing.

The government doesn't produce anything. They tax and mostly they print money, which is a tax on savers. Photo courtesy of http://www.flickr.com/photos

And ethically and morally, if you think this is back in the old days of the 19th century when ?a man pays his debts back? you have swallowed the propaganda hook line and sinker. The fact is that today, it is ethically bankrupt and immoral the way the banks are propped up at the expense of those who save. But there is no way around it. They are destroying the money supply.??

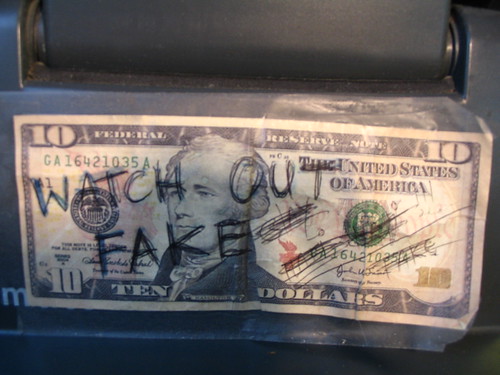

The nation’s central bank counterfeits dollars. These are fake! Photo courtesy of http://www.flickr.com/photos/ericskiff/

?

Do you think the government, who is the world?s biggest borrower, will ever pay back what it borrowed? Of course not. And neither should you, if doing so would cause years of pain and struggle.

Why escaping debts through settlement is not immoral or wrong

So my formula is to settle your debts for dimes on the dollar, and avoid whatever got you into this situation in the first place. But don?t struggle and practically die over trying to pay back this debt. The entire system is stacked against you.????

It?s designed so the cost of living escalates higher and higher due to inflation from all the government-printed money. And meanwhile you cannot pay back the money you borrow. You are able to pay the interest on it. So all your extra surplus above and beyond living expenses gets paid to the banks.?

Then, you can?t send your daughter to college, or buy a house or do anything without borrowing still more money.

You are a serf, a debt serf, and your existence depends upon the continued extension of more and more credit by the banks. Can you be happy this way? Sure. Can you ever become independent and free? No. Not unless you get out of this debt and turn the money you?ve been paying the banks into savings for your future.

So you owe it to your family to do what you have to do. Stop incurring new debt. Settle the old debt. And move on with your life, putting the money you were paying the banks into intelligent savings vehicles for your family?s future.

It’s great to graduate college — and even better to buy your education for all-cash. Possible? Yes. Photo courtesy of http://www.flickr.com/photos/_lisamarie_/

?

You are a serf, a debt serf, and your existence depends upon the continued extension of more and more credit by the banks. Can you be happy this way? Sure. Can you ever become independent and free? No. Not unless you get out of this debt and turn the money you?ve been paying the banks into savings for your future.

So you owe it to your family to do what you have to do. Stop incurring new debt. Settle the old debt. And move on with your life, putting the money you were paying the banks into intelligent savings vehicles for your family?s future.??

How minimum payments are wrong for many folks

If you?ve just run into a bad patch and you have run up a lot of credit card debt, and your income is going to go up and you?ll pay the debt off, then this article isn?t really talking to you.??

I?m talking to people who are making minimum payments over a long period of time. Dragging this ball and chain with them through the years.

If that?s you, then I suggest you consider stopping. Because by continuing to pay $500 or $1000 or more to the banks every month, you are shortchanging your family?s future.

?

If you pay minimum payments on $50,000 in credit card debt, over 27 or so years you?ll end up paying out $277,000 to the banks.

This is $277,000 that comes out of your after-tax what?s-left-over income, the most valuable income there is. If you invest this instead in gold or silver coins, or in your daughter?s college education, or in some good real estate, you an build a future for yourself with independent comfortable and free living, as opposed to relying upon the banks and the government and being a debt slave.

Think about that. $277,000 is a good amount of money. And by settling your debts instead, you can often save that $277,000 and build it up into your nestegg that will serve you for life.

You don’t have to be on the street to be poor.

If you are in debt up to your eyeballs and have

been for some time, you are not in a good place.

Photo courtesy of http://www.flickr.com/photos/dorkymum/

?

How to settle your debts for dimes on the dollar

The basic system is very simple. You quit paying your bills. And you settle with the banks. They get more money if they cooperate with you and settle, than they would if they don?t.

So they settle.

You can settle debts inside of a bankruptcy process, or without bankruptcy. Sometimes it pays to file for bankruptcy protection. You can save on taxes this way in some cases, and you can get a fresh start.

Please understand that I?m not advising you to quit paying your bills, or to file for bankruptcy. Dimes on the dollar is a way to settle your bills outside of bankruptcy, which may work better for some.

The downside to bankruptcy is that you have the bankruptcy on your credit record and the public record. Few things look worse to a creditor or an employer than bankruptcy.

But the other downside is that you often have to stay in bankruptcy process for up to five years. First you file, then you are in the process for at least 4 to 6 months, and then your discharge gets rid of most or all of your debts. Except if you are forced into a chapter 13, in which case your discharge is years away.

Often it is best to settle without bankruptcy. Your creditors get more. You avoid bankruptcy. And you end up with decent credit quite often in 12 to 18 months.??

Yes, that?s right. Your credit score will go to all heck for awhile, but you can do some very easy things to bring your credit score up and have it be quite good in 12 to 18 months from when you stop paying your monthly payments.

How to use your retirement cash for debt settlement

The key is that you must have lump sum settlements to offer your lenders. And you can accumulate those how? From your retirement cash. We have a system using the Checkbook Retirement Plan that lets you settle your debts using my Dimes on the Dollar method using lump sums from your Plan.

Now, your plan continues to grow tax deferred, and you are out of all debt. You can hold your head up high. You?ve done your family and yourself a huge service.

?

Use a good attorney ? here?s how

All you need is the know-how and the courage to do this. It?s easy to do. The know-how is easy. And the courage it takes is something you can pick up pretty easily. I suggest you look into this very seriously. I will always advise you to consult with a good attorney and accountant before you do anything, so you know what your liabilities and options are or what could happen.??

So please make SURE you consult a good attorney even if it?s for just an hour. A bankruptcy attorney you consult should outline CHOICES for you similar to the choices discussed in this article.

The attorney shouldn?t try to shoehorn you into bankruptcy. I also like an attorney who does mostly Chapter 7s. I?m not saying you should file for bankruptcy. But having consulted a good attorney, you will feel a LOT better.

And you can tell creditors that you have met with so-and-so who is a bankruptcy attorney.

Plus if you get settlement agreements or any law suits, you can ask your attorney about them and for a small amount of money get a LOT of help and reassurance.

It’s a secret — you can use retirement

cash to build up your nestegg and get out

of debt at the same time. Photo courtesy of

http://www.flickr.com/photos/stevendepolo/

I hope you have enjoyed this article. If you do this right you can end up debt free, with growing amounts in your retirement account, and you?ve done something most folks can only dream about.

By Marc Duuis August 7, 2011 - 7:58 pm

wondering if this strategy applies to bank and credit card companies in Canada as well as in the US?

By Joanne August 12, 2011 - 4:09 pm

Hi Marc,

It’s not the banks and the credit companies that will or will not make this strategy work, it’s whether or not the retirement account you guys have in Canada works like an IRA account where you are allowed to borrow up to 1/2 of the amount in your account and pay it back over time. This I do not know.