What does the road to financial freedom look like for you?

Here’s what it looks like for me…

- Paying off all consumer debt (I have a lot) and being debt free

- Contributing to my Infinite Banking life insurance policy so that I can be my own bank

- Investing in tax liens because they are not tied to the stock market, or the federal interest rate

Your road to financial freedom might look completely different than mine. It might look something like this and have nothing to do with an infinite banking policy or tax lien investing…

- Both spouses working in full time jobs with good salaries and benefits

- Investing in long term and short term rental properties

Whatever your personal path to financial freedom is there are 2 things that will help you get there faster. And that is…

- Having the right mindset

- Operating within your Money DNA (i.e. the way that your mind is wired)

That’s why for our next Wealth Building Webinar, I’m bringing an expert to help with both of these things. In fact I refer to him as the Millionaire Maker, because quite frankly that is what he does. I believe in him so much that I’m working with him myself. And I want to bring his insight to you.

Our Next Wealth Building Webinar

So join me on our next Wealth Building Webinar, at a different time this October because I will be traveling at National Tax Lien Association Symposium on the usual time. This month the Wealth Building Webinar will be on Tuesday, October 11 at 7pm Eastern Time/6pm Central/5pm Mountain/4pm Pacific.

>>Register to join us live HERE<<

It’s free to come to the live training. and the training will be recorded for members of Wealth Building Webinars. Don’t miss any of the future Wealth Building Webinars! It’s only $49 per month to get all of the Wealth Building Webinar recordings including the archived recording from the last couple of years. And I don’t want you miss some of the future trainings on great topics like how to fire the IRS and keep more of the money you make in your business, how to get out of debt faster and be your own bank. And of course trainings on different aspects of tax lien and tax deed investing.

But that’s not all you get when you become a member of Wealth Building Webinars. You also get access to my Tax Lien Investing Basics course (a $297 value). This course was designed to help you with 2 things:

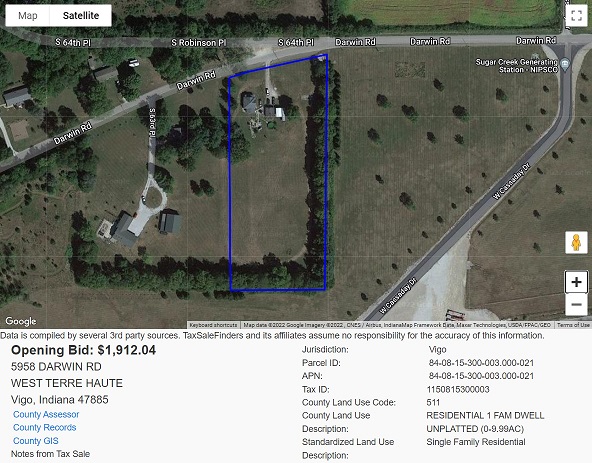

- Finding the best place for you to invest in tax liens and/or tax deeds

- Getting all the tax sale information you need to participate in the tax sale

Follow Us!