Another nugget of wisdom from Be Motivated Today:Psychologists: Holmes, Rahe and Masuda produced a schedule of tension producing experiences and assigned a score to each. The higher the tension associated with the event the higher the score.Things high on the list are:

Lower down we find:

They did not include:

How much stress have you been under in the last 6 months? Be Motivated Today members can download?an e-workbook on effective stress management under the RECOURSES tab in the member’s area. Affirmations: Be all you can be. With Fond Regards Arnfried Klein-Werner |

| Want to receive these encouraging and inspiring emails? Register for a 14-day FR’EE Trial of the Daily PEP-Talk at http://www.BeMotivatedToday.com/71058. Watch a short video and download an e-book on releasing your potential and a report on a unique way to help you create a passive income that actually works. Visit http://www.BeMotivatedToday.com/71058. |

Monday Motivation: How Stressed Are You?

Avoiding The Competition At Tax Sales

I know that one of your biggest challenges as a newbie tax lien investor is avoiding the competition at tax sales.

When you hear about how fierce the competition is at the tax sale, you’re likely to give up and throw in the towel on tax lien investing before you even get started.

So I thought that I’d share with you some ways that I?ve been able to still get double digit returns on my tax lien portfolios regardless of the competition. I have 3 different strategies that I use, 2 of them are strategies that I use for live tax sales and the other one is a strategy that I use for both online and live tax sales. Continue reading

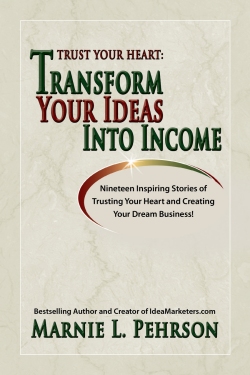

Today Is Lauch Day For Trust Your Heart!

Today is the day!

Trust Your Heart: Transform Your Ideas into Income has just launched, and you can get your copy now and access our one-of-a-kind bonus!

Can you really take an idea and turn it into a successful, mega-profit business?? Are there shortcuts for doing just that?

Is this dream just for the lucky ones, or can anyone transform an idea into cash?

Trusting Your Heart: Turning Your Ideas into Income – the newest book from IdeaMarketers.com – blows the lid off excuses and reveals how 19 individuals (including your truly) with a dream turned their ideas into thriving businesses.

You’ll discover how one immigrant from Poland with just $190 in his pocket became a multi-millionaire.? How an illegal deal at a big company sent one soon-to-be-entrepreneur packing.? How one budding actress walked away from acting to serving Italian food to the biggest names in Hollywood to creating her own coaching business! Continue reading

Can I Invest In Tax Liens With Money From My Retirement Account?

Here’s a question that I get often: “Can I invest in tax liens with money from my retirement account?”

The answer to this question is yes, if you have a self-directed IRA or solo 401(k). But what is a self-directed IRA or Solo 401(k) and how can you tell if your retirement plan is self-directed?

A self-directed IRA is an IRA account – it could be a traditional IRA or SEP IRA, or Roth IRA, that lets you direct where the money is invested. The bad news is that many brokerage houses say that their account is self-directed, but they don’t let you invest in anything that they don’t sell – this is not a true self-directed account. A real self-directed retirement account is held by a custodian that doesn’t sell any investments. They can offer you education about different investment opportunities that you can participate in with your IRA, but they are not legally allowed to sell you the investment. Continue reading

Are You A Quitter?

Here’s some Monday Motivation from my friend Arnfried Klein-Werner of Be Motivated Today:

Success is all about perseverance – not giving up, doing your best, keeping at it – when you would rather quit and rid yourself of the whole ‘mess’.

But when we quit, we can forget about achieving the goal we are working towards. It’s like running a long-distance race – a marathon. At the start, you feel strong and full of enthusiasm, but as the miles take their toll on your energy reserves, you think to yourself, ‘Why am I doing this? This is tough!’ If you decide to quit you are immediately out of the race. It’s over for you. There is no committee that sits down at the end and decides whether or not you should still get a medal. No one says: ‘Ah shame! S/he tried so hard in the beginning, can’t we just give it to him/her?’. No! There is no vote. Continue reading

Follow Us!