Purchasing tax deed properties at the tax sale is one way to get a property free and clear of a mortgage for less than retail price. It used to be a way to get properties for pennies on the dollar, but it doesn’t seem to work like that anymore. Unless you’re just bidding on vacant land in areas where no one wants to live, you’ll have to bid against other investors with deep pockets. And sometimes these so called investors will pay near market price for a tax deed property. Even if they bid up the price to 80% of market value, that’s more than you should pay for a tax deed property. Because you’re unable to inspect the property before you buy, you really don’t know how much rehab it’s going to need. If you pay 80% of market value, that might cut your profit margin quite a bit. And you can’t even be sure exactly what market value is, especially in today’s market, where prices are still not stable.

So what is an investor to do? Well there is a way that you can purchase properties in advance of the tax sale, from the owner. Did you know that a large percentage of tax delinquent properties are free and clear – that is they don’t have a mortgage on them. What if you could find tax delinquent properties that are free and clear and purchase them from the owner. What if the owner was willing to sell the property cheap just to avoid paying the back taxes and the other headaches associated with owning an unwanted property? And what if you could have that property sold before you even purchased it?

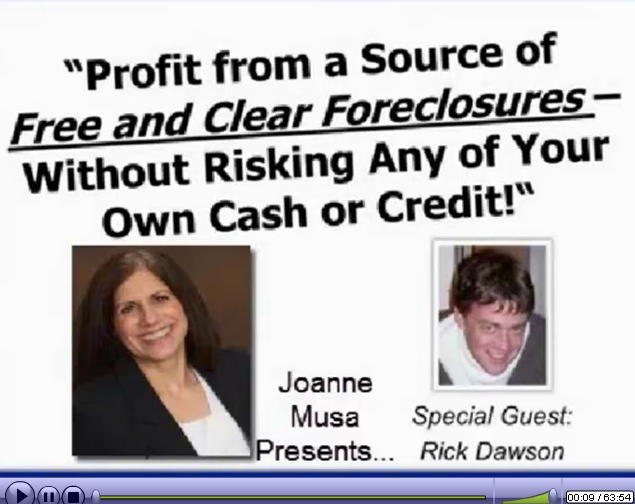

This is what Rick Dawson teaches his students how to do in his Tax Sale Profits program and what he taught in our free webinar last Thursday. If you missed it you’ll want to listen to the replay. Here’s what one of the participants had to say about it:

“I am eager to see if this works in my area.? Thank you Joanne for the various strategies to invest in real estate that are alternatives to the regular buy and sell of real estate.? I also appreciate the approaches? to lower my risk for profit.”

— Cindy Hollandsworth

During this training Rick let us know how you can get the list of tax delinquent properties from the county for free! This information will help you with other strategies as well. Like buying tax sale properties and letting them go to the sale, and then collecting the excess proceeds. With this strategy if you wait until the tax sale list is published, that can be too late, so it’s always better to get the delinquent tax role, but that seems to be where most people get stuck. Rick’s tip of how to do this can save you a lot of time and money!

Listen to the replay now to find out how you can profit from tax sale properties without risking any of your own cash or credit — and how to get the delinquent tax list for free! Also in the replay you’ll discover how to save $300 on Rick’s course…

Get the replay here:

http://taxlienlady.com/WebinarTraining/FreeAndClear.html

Then go to https://deedgrabber.infusionsoft.com/go/tsp/taxlienl/?to get his course as $300 off as showed on the webinar.

By Tory December 16, 2011 - 11:35 am

Hi Joanne,

I attended the webinar training with Rick Dawson. And I’m curious to know if you’ve actually attempted this strategy yourself? If so, did you find it highly successfull? Are there any other things we should know from you experience with this particular strategy (assuming you’ve tried it)?

By Joanne December 19, 2011 - 11:21 am

Hi Tory,

I haven’t actually tried this strategy because I just don’t have the time to do everything. With keeping up my web site and teaching people how to invest in tax liens I barely have time to go to tax sales. I like tax lien investing because I don’t really want to deal with properties. I like using tax lien investing as an alternative to the stock market. I did, however, about 3 or 4 years ago, attempt to purchase tax delinquent properties from the owner before the tax sale. At that time the economy was just starting to slow down. Houses were still selling, but land was not, and I was concentrating on land. Oddly enough the owners of the good parcels of land did not want to part with them for a small consideration. They wanted what they were worth when they purchased their property 20 years ago, which was about twice the value at the time that I was trying to purchase them. I did find people who would sell me their land for a small amount, or even give it to me. Only problem was it was not buildable land. I’m sure that if I were to continue this strategy today I would find people willing to sell their property, as times have changed and property is not even worth was it was a couple of years ago. And I know that some people are now in a position where they just don’t want to pay the taxes anymore.

I really think that it depends on your area. I think that in my area I was close enough to New York and Philadelphia that people thought they would always be able to get value out of their property. I don’t think that they are thinking that now. I think that the key is find an area that is far enough away from the big cities but where people are moving into, and where there are good schools and decent paying jobs. In areas farther away from the big cities it will be easier to get properties cheap and in areas where people want to live, because of the job availability and good schools, those same properties will be easier to rent or to sell.