I went to a tax lien sale in New Jersey this week and was able to get 2 small tax liens. The tax sales in New Jersey are not like the tax sales in the rest of the country. There are no county tax sales. Everything is done on the municipal level. Each municipality has their own tax sale. This is both good and bad for the investor. Good, because there are over 500 municipalities in NJ and each of them has a tax sale once a year. So you can find a tax sale somewhere in the the state almost any time of the year. Bad, because you have to attend a few tax sales in order to get your money invested. Continue reading

I went to a tax lien sale in New Jersey this week and was able to get 2 small tax liens. The tax sales in New Jersey are not like the tax sales in the rest of the country. There are no county tax sales. Everything is done on the municipal level. Each municipality has their own tax sale. This is both good and bad for the investor. Good, because there are over 500 municipalities in NJ and each of them has a tax sale once a year. So you can find a tax sale somewhere in the the state almost any time of the year. Bad, because you have to attend a few tax sales in order to get your money invested. Continue reading

From The Field: Tax Sales In New Jersey

From The Field: Florida Tax Sales

Florida is the state with the most online tax lien sales. Now that they’re over it’s a good time to take a look at the results and how some of you fared in the Florida tax sales. I always get a few e-mails from new investors that try to participate in the Florida online tax sales. Invariably, they make the mistake of bidding too high on the wrong properties and don’t get anything. Continue reading

Florida is the state with the most online tax lien sales. Now that they’re over it’s a good time to take a look at the results and how some of you fared in the Florida tax sales. I always get a few e-mails from new investors that try to participate in the Florida online tax sales. Invariably, they make the mistake of bidding too high on the wrong properties and don’t get anything. Continue reading

Monday Motivation: Using Empathy To Have Better Relationships

Here’s an audio message from my friend Arnfried at Be Motivated Today:

For the first time I have put my thoughts on the powerful relational skill of showing empathy into audio format. I look briefly at why it is so important, how to apply it in relationships and resolving conflicts. It is just a short 7 minute audio that will help you develop stronger relationships.

For the first time I have put my thoughts on the powerful relational skill of showing empathy into audio format. I look briefly at why it is so important, how to apply it in relationships and resolving conflicts. It is just a short 7 minute audio that will help you develop stronger relationships.

Listen to it at http://www.bemotivatedtoday.com/content.asp?pageId=244&refcode=71058

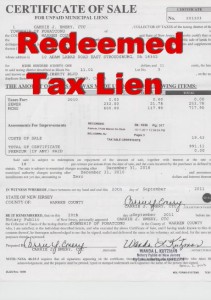

Another Tax Lien Redemption!

I just deposited another check from a tax lien redemption today!

I just deposited another check from a tax lien redemption today!

Sometimes I get so excited about what I’m going to do with the money from a tax lien redemption that I forget to make a copy of the check before I deposit it to show you the proof. But that’s not real proof anyway. The real proof of how much I made from tax lien investing is the 1099 forms that I get in January of the following year. That’s because the 1099 forms show not how much money I get back from the county or municipality, but how much interest I’ve made.

This check was for a little over $1500, but if you’re interested in seeing the breakdown of just how much I really made, since most of that money was money that I invested in the first place, here’s the breakdown from my tax lien software program: Continue reading

New Update To Buying Tax Liens Online Course

The Buying Tax Liens Online course has been updated again for 2012, this time with bonus videos for the Louisiana online tax sales.

The Buying Tax Liens Online course has been updated again for 2012, this time with bonus videos for the Louisiana online tax sales.

The big rush for the Florida online tax sales is over but there are still online tax sales this summer in Maryland, Indiana, and Louisiana. You won’t find how to information for these tax sales anywhere else! Continue reading

Follow Us!