I get a lot of questions and comments about over-the-counter tax liens and deeds. Many beginners want to know how to buy liens or deeds directly from the county and circumvent the auctions. They’ve been told that there are always leftovers available and that you can avoid the competition at the tax sale by purchasing left-over tax liens or tax deeds directly from the county instead of bidding on them at the auction. Continue reading

I get a lot of questions and comments about over-the-counter tax liens and deeds. Many beginners want to know how to buy liens or deeds directly from the county and circumvent the auctions. They’ve been told that there are always leftovers available and that you can avoid the competition at the tax sale by purchasing left-over tax liens or tax deeds directly from the county instead of bidding on them at the auction. Continue reading

Are Over-The-Counter Tax Liens And Deeds Deals Or Duds?

The Easy Button For Tax Lien And Tax Deed Investing

Watch this short quick tip video to find out about what I call the easy button for tax lien and tax deed investing:

What You Should Know About Arizona Tax Sales

There have been a few changes to procedures in some counties for the Arizona tax sales in the last 3 years, particularly the online tax sales. Here’s what you need to know for the upcoming online tax sales in Arizona.

There have been a few changes to procedures in some counties for the Arizona tax sales in the last 3 years, particularly the online tax sales. Here’s what you need to know for the upcoming online tax sales in Arizona.

The Single Simultaneous Bidder Rule

Pinal and Yavapai counties incorporated this rule in 2014 and Coconino county included the “single simultaneous bidder rule” the following year. When this rule is in effect, not only can you not bid under a different name or entity, but when you register to bid at one of these tax sales, you cannot have a contractual, legal or financial relationship with any other bidding entity registered in the same sale. That means that anyone who files a joint tax return with you is not allowed to register in that tax sale, and any entity that you are involved in is not allowed to register to bid at the tax sale either. So if you have shares in a fund or other entity that bids at a one of these tax sales, then technically you cannot register to bid in that sale. Continue reading

Arizona Tax Lien Sales

The Arizona tax lien sales are going on now!

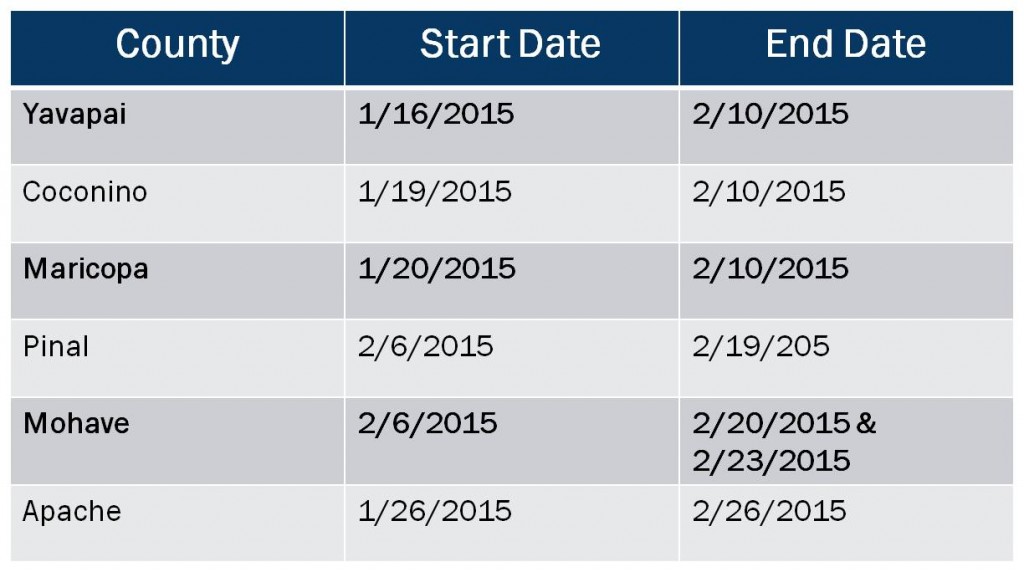

Six of the Arizona counties have online tax lien sales and they are going on now. Three of them will end next week. Here’s a list of the AZ counties that have online tax sales with the start and end dates of the auctions.  I’ll be doing a training for these Arizona tax lien sales starting Thursday February 5. This is a Done-With-You training where I’ll show you how to register and bid at the tax sale, while these tax sales are going on. The training is limited to only 10 participants so that I’ll be able to give everyone in the training individual attention. This training is almost full but we do have 3 spots left. Find out more at http://taxlienlady.com/done-with-you.htm.

I’ll be doing a training for these Arizona tax lien sales starting Thursday February 5. This is a Done-With-You training where I’ll show you how to register and bid at the tax sale, while these tax sales are going on. The training is limited to only 10 participants so that I’ll be able to give everyone in the training individual attention. This training is almost full but we do have 3 spots left. Find out more at http://taxlienlady.com/done-with-you.htm.

Tax Lien Investing Events And Deadlines

Here’s some upcoming tax lien investing events and deadlines that I thought you’d like to know about….

Feb 2:

Early Bird Deadline for Done-With-You Training for the Arizona Online Tax Lien SalesThere are only 4 spots left for this training. Training starts on February 5.

If you haven’t seen the preview webinar you can get it now at: http://taxlienlady.com/arizona-tax-liens.htm

Feb 4:

TaxLienLady’s Q & A Teleseminar The topic of our this month’s teleseminar is “Tax Sale List Magic.” Find the best way to get tax sale lists and all the informationon you need to get the best deals? Register now at: https://attendee.gotowebinar.com/register/8222854203172847361

Feb 11:

Compimentary Webinar This month’s guest is going to show a brand new research tool that is revolutionizing the business of tax lien investing. It makes getting the tax sale and doing due diligence super easy. You can get more information and register now at: http:taxlienlady.com/WebinarTraining

Feb 18:

Member Training The next member training for the Tax Lien Profits Accelerator is, Wednesday February 18. Learn more about member benefits at: http://taxlienlady.com/MembershipMain.htm

Mar 4:

TaxLienLady’s Q & A Teleseminar The topic of this month’s teleseminar is OTC Liens and Deeds: Deals or Duds? I’ll be answering all of your questions on this free call. Register now at: https://attendee.gotowebinar.com/register/2952147303335688962

Mar 13-15:

Bus Trip! That’s right we’re planning a bus trip. Stay tuned for more information, but for now, if you’re serious about about investing with experts that will do most of the heavy lifting for including all the due diligence and teach you how to do it … then set these dates aside now!

If you have any questions about any of these dates or events, please let me know.

I look forward to helping you profit in 2015!

Follow Us!