What are you doing to build your wealth in the new year?

Wow, I can’t believe another year has gone by. I was reading my post from January 1 of 2023, and it seems like it was a long time ago. What a difference a year can make!

Wow, I can’t believe another year has gone by. I was reading my post from January 1 of 2023, and it seems like it was a long time ago. What a difference a year can make!

Last year I spent New Years Day at home with COVID for the second time. This year I had all this energy and I found myself doing things around the house. Odd things that I had not planned like:

- Cleaning my front door.

- Buying evergreen shrubs put on either side of the door.

- Replacing the old beat-up door mat with a new one.

- Dressing up my dining room table…

And a few more things I won’t mention, but you get the idea. I was inspired by one of the speakers for the upcoming Wealth Building Conference that we’re doing starting January 15!

My Inspiration

This will be my 4th annual Wealth Building Conference and like last year, it’s virtual and all pre-recorded. So, I’ve been interviewing experts for the on different topics of building wealth over the last couple of weeks. One of these experts is a Feng Shui expert who talked about Feng Shui for wealth. I was so inspired by her that I started making some changes in and around my home to invite in more wealth for 2024. When you hear her interview, maybe you’ll get some ideas of how to move your stuff and create wealth!

Each of the experts that I’m interviewing for this year’s Wealth Building Conference are so inspiring. I’m interviewing experts on topics like

- How your kids can get paid to go to college.

- Philanthropy and other attitudes of the wealthy.

- How to make money twice on your investments.

- Plus 4 experts on real estate investing strategies that are working great in today’s market.

- And 2 mystery experts that I’m not going to divulge yet.

What are your plans for the new year?

I also spent some time with my husband today talking about our plans for the coming year. We talked about things we would like to do this year and habits we’d like to start. Like eating a green salad every day, starting a regular exercise program, cutting down on drinking wine and bear, eating more fruits and veggies, fixing up specific areas in our home, getting a new car.

More importantly we talked about the little steps that we’re each going to take this week to get us closer to our goals. I’m going to check out the local YMCA, it’s the only place around here that has a pool. I’m also going to find someone to start work on the room that we’ve been talking about renovating for the last couple of years. And we’re going to look through FB marketplace for local used cars for sale that fit our criterion.

What are your plans for the new year and how will you accomplish them?

Build Your Wealth in 2024

One of things that I’ll be doing in January is continuing to interview experts for the 2024 Wealth Building Conference on how to attract more money into your life, manage your money better, and make your money work harder for you. I’ll be delivering these recorded interviews starting January 15 to everyone who registers for the event.

This year the conference will be all pre-recorded, so you don’t have to show up at a specific time to watch the interviews, and we’ll have more than 10 experts for you to learn from. There will be something for everyone. And the best part is you can sign up for free! Register now at www.2024WealthBuildingConference.com and get ready to make 2024 your best year ever!

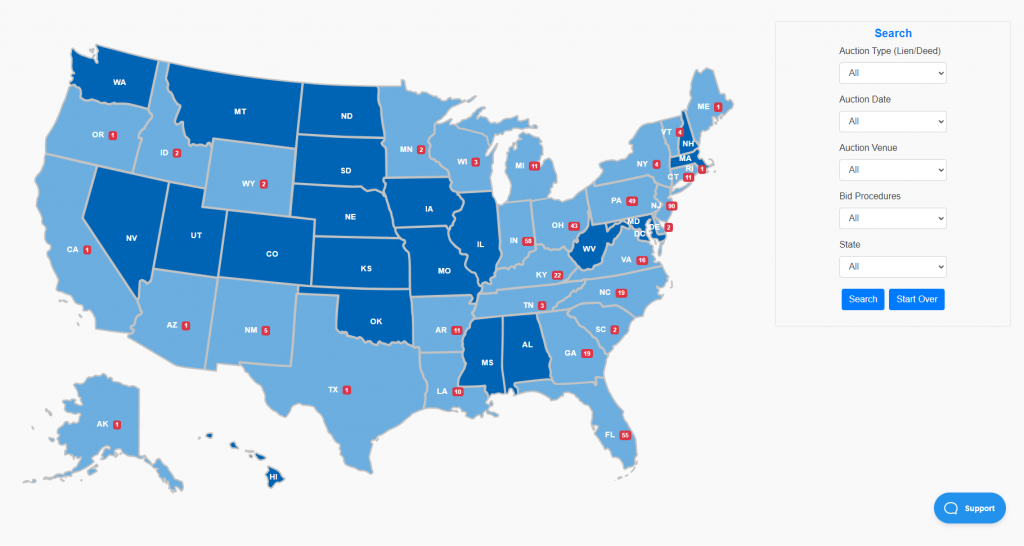

If you take a look at successful people in any field, more often than not you’ll find that they did the exact opposite of what everyone else was doing or what they were “supposed” to do. This is especially true when it comes to investments. The truth is that what they say about tax lien investing is wrong…

If you take a look at successful people in any field, more often than not you’ll find that they did the exact opposite of what everyone else was doing or what they were “supposed” to do. This is especially true when it comes to investments. The truth is that what they say about tax lien investing is wrong…

Follow Us!