Who was Saint Valentine?

How did Saint Valentine’s Day start and who was Saint Valentine? Saint Valentine was a real person, maybe even more than one person, who lived in the 3rd century and who’s death is celebrated on February 14. But what has that got to do with lovers, hearts and cupid? Well it doesn’t have anything to do with cupid, but here is where some of our St. Valentine’s Day traditions come from…

The stories that we have of St. Valentine, may be stories of the same person of 2 different clergymen that were both martyred and buried along the Via Flaminia to the North of Rome sometime between 269 and 280 AD. Saint Valentine was imprisoned for performing Christian weddings and for aiding persecuted Christians. He was tolerated and even liked by emperor Claudius until he tried to convert the emperor and his household to Christianity. He was then sentenced to execution by being beaten with clubs, then stoned and finally beheaded.

Where did Saint Valentine’s Day Cards Originate?

At one point in his ministry, Valentine, the former bishop of Terni, a town of Umbria in central Italy was under house arrest with judge Asterius, who’s daughter Julia was blind. When Saint Valentine restored the sight of the judge’s daughter, he and his household were converted to Christianity. Later when Valentine was condemned to death by Claudius II, before his death, it is said that he left a note to Julia and signed it “Your Valentine.”

Another account of Saint Valentine maintains that he was a priest who secretly performed Christian weddings and that he was known to cut hearts out of parchment and give them to soldiers and persecuted Christians to remind them of God’s love. This could be where we get the tradition of sending hearts and heart shaped gifts on Valentine’s Day.

“St. Valentine is the Patron Saint of affianced couples, bee keepers, engaged couples, epilepsy, fainting, greetings, happy marriages, love, lovers, plague, travelers, and young people. He is represented in pictures with birds and roses and his feast day is celebrated on February 14.”

Source: https://www.catholic.org/saints/saint.php?saint_id=159

In Honor of St. Valentine and Other Who Are Martyred For Their Faith

You may think that the story of St. Valentine’s death is a brutal one and things like this only happened in the early days of Christianity. If so, you’d be wrong. There are more Christian martyrs today than in any time in history. According to Help The Persecuted (http://htp.org) 245 Million people around the world are in danger of being persecuted because of their belief in Jesus, and every 6 minutes a Christian is killed. They have a 3 minute video on their website and on YouTube where you can learn more and see what they do to help.

Another one of my favorite charities that serves persecuted Christians world wide is Voice of the Martyrs (www.persecution.com). The Voice of the Martyrs is a nonprofit, interdenominational Christian missions organization founded in 1967 by Pastor Richard Wurmbrand, who was imprisoned for 14 years in Communist Romania for his faith in Christ. You can read his story in Wurmbrand: Tortured For Christ the Complete Story.

In honor of Saint Valentine and persecuted Christians today, For the rest of this month, I’m offering a my Tax Lien Investing Basics course – a $297 value, for free to anyone who contributes at least $20 to either of these organizations. Already have my Tax Lien Investing Basics course? I’ll give you a $297 credit to any of my other courses! Just send me your receipt after you donate at least $20 to either Help The Persecuted or The Voice of the Martyrs.

So send a little love this Valentine’s Day to persecuted Christians around the world and get a free access to my Tax Lien Investing Basics Course or a $297 credit to one of my other courses!!

Earning double digit returns or more on your tax liens or redeemable tax deeds may seem like an unattainable or “far away” goal. I’m hoping this article will inspire you, and show you that you really can do it.

Earning double digit returns or more on your tax liens or redeemable tax deeds may seem like an unattainable or “far away” goal. I’m hoping this article will inspire you, and show you that you really can do it.

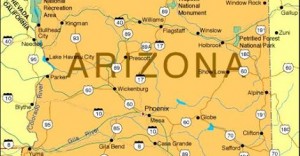

If you’ve been wanting to invest in tax liens, right now is the time to start, because registration and bidding for the Arizona online tax sales start in January. But don’t bid at these tax sale auctions until you get some education…

If you’ve been wanting to invest in tax liens, right now is the time to start, because registration and bidding for the Arizona online tax sales start in January. But don’t bid at these tax sale auctions until you get some education…

Follow Us!