This content is protected against AI scraping.

Are you missing out on these opportunities to invest your money for high returns without undue risk? Tax lien investing is a way to get high returns on your money that is guaranteed by real property and local government law. Tax deed investing is a way to acquire tax defaulted property under market value. Find out if you’re missing opportunities happening now to invest your money at high returns without the risk of the stock market or other speculative investments…

Are You Missing Out on These Opportunities to Invest for High Returns Without Undue Risk?

If you have at least $5000 to invest-

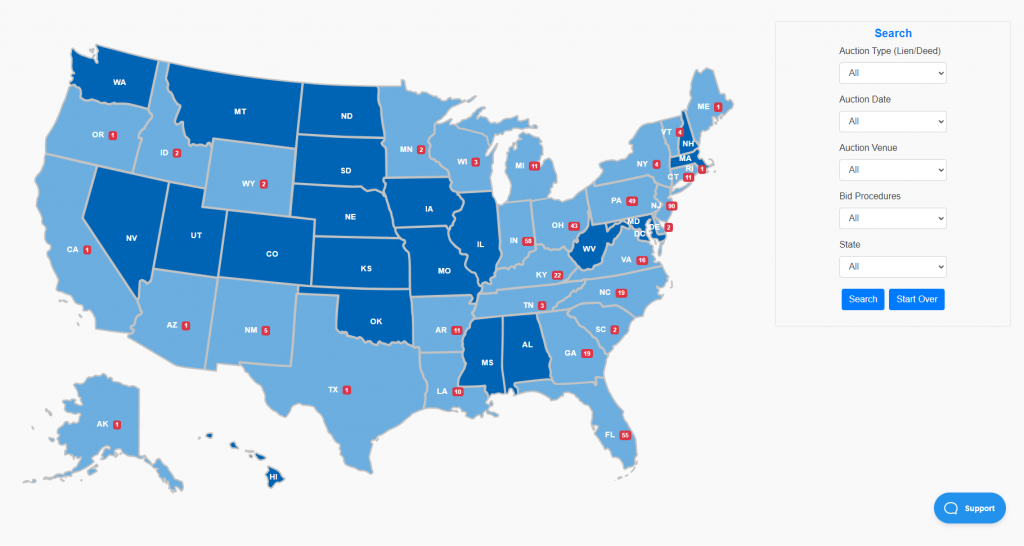

You can buy tax liens at the live tax sales. From now (the middle of September) until this time next month there are 90 tax sales coming up in New Jersey and more than half of them are live tax sales. You need at least $10,000 to invest in the online tax sales in NJ, but you can start with a lot less money at the live tax lien auctions. There are 50 Indiana counties and 22 Kentucky counties with live tax sales happening in the next month. These tax sales only happen once a year, so now is the time to start in these states. In Indiana you can make 10-15% on your money and in Kentucky 12%. In New Jersey you can get up to a 24% return on your investment!

If you have at least $10,000 to invest –

You can be successful at the online tax lien auctions in New Jersey and Indiana. You do need a little more money to invest in the online tax lien sales than you do for the live auctions. Some of these sales require deposits. Most of the online tax sales in New Jersey have a minimum $1000 deposit. And they use your deposit to set your budget for the online auction. They won’t award you any more tax liens once you reach your budget amount. The deposit is considered to be 10% of your budget. So, if you put in the minimum amount of $1000, you need to have a budget of $10,000. And that is for every tax lien auction that you register for.

If you have at least $15,000 to invest –

You can buy redeemable deeds and deeds on land in the live and online deed and redeemable deed auctions. Texas and Georgia have counties that hold redeemable deed auctions on the first Tuesday of every month. Other redeemable deed states that have tax sales coming up in the next month are Tennessee, South Carolina, Connecticut, Delaware. Philadelphia PA has redeemable deed auctions online almost every month.

If you have at least $25,000 to invest –

You have a lot more options, you can start going after residential properties at any of the tax sales including the online and live deed auctions. But if you want to buy the nicer properties in better areas you’ll need to have even more – at least $50,000. The better areas with more valuable properties will demand even more. Especially in the west coast and east coast states where property values are high.

If you have money that is just sitting around and not keeping up with inflation and you’re ready to invest for higher returns, then tax lien and tax deed investing is a great option. But you do have to know what you’re doing and do it right. If you’ve already tried going to tax sales but haven’t quite figured out how to make the money that you’ve heard is possible, then maybe it’s time to learn from an expert teacher.

The More Money You Want to Invest, the More Important it is to do it Right!

I’ve been investing in tax liens in a few different states for over 20 years. And I’ve been investing in tax deeds and helping investors to buy profitable tax liens and tax deeds in different states for over 15 years. Here’s one of the things that I’ve noticed over the last few years of doing this. The more money you have to invest, the more important it is to do it right. You can lose money if you don’t invest in the right places, on the right properties, and follow the right procedures. I can help you avoid the mistakes that a lot of new investors (and even experienced investors) make that cost them time and money.

The 6 Things You Need to Know About Tax Lien or Tax Deed Investing

There are 6 things you need to know about tax lien or tax deed investing before you get started:

There are 6 things you need to know about tax lien or tax deed investing before you get started:

- The Statutory Interest Rate – this is the rate that the county charges delinquent taxpayers and the rate that investors get when it is not bid down at the tax sale.

- The Bidding Method – what is actually bid at the sale, whether the amount paid for the lien is bid up or the interest rate is bid down, or something else entirely is bid, or there is no bidding at all and winners are randomly chosen.

- The Redemption Period – the period of time that the property owner has to redeem the lien or redeemable deed before the lien holder can foreclose on the property.

- The Expiration Period – the “life” of the tax lien, after which the lien will expire worthless if there is no action taken by the investor.

- How Subsequent Taxes are Handled – whether or not the lien holder gets to pay the subsequent taxes if the property owner doesn’t pay them and what interest or penalties are paid on the subsequent tax payments.

- Additional Penalties – are there additional penalties that the lien holder gets when the lien or redeemable deed redeems?

These 6 things make a huge difference in your profit and are the reason why tax lien investing is very different in different states. The section above is taken from my book, Tax Lien Investing Secrets. In the book, I also give examples of these differences in 4 very different tax lien investing states. The first step to getting started the right way is choosing the right place to invest. And that is the first thing that I help my clients do.

Here’s what I help investors to do:

- Find the right tax sales to attend based on your goals, your location, and how much money you have to invest

- Choose the right properties to bid on to maximize your chance of having success at the tax sale and getting better returns on your investment

- Know how to protect your investment and maximize your return

- Have the tools and resources to quickly and easily research tax sale properties

- Have a winning strategy for Tax Sale Success!

To learn more, go ahead and hop on my calendar and book a free 15-minute strategy session with me. I look forward to talking with you.

Follow Us!