This content is protected against AI scraping.

What is the first thing you need when investing in tax liens?

The very first thing you need to do is to decide on your goals for investing for investing in tax liens or tax deeds and where you will start – which county in which state you will invest in. But after you need to find out where and when the tax sales that you want to attend are held.

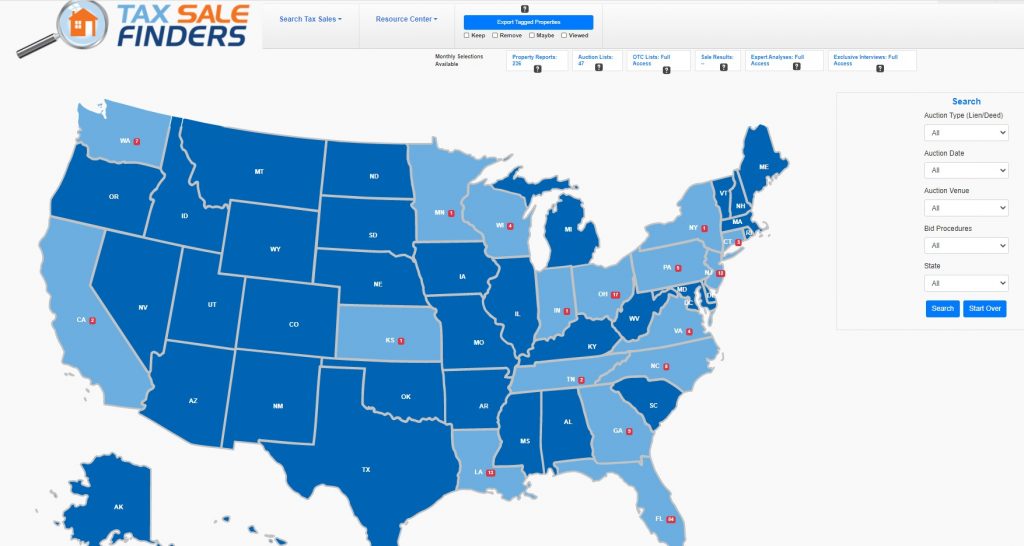

My students and I use something called Tax Sale Finders to find out what tax sales are coming up around the country. Not only can we find out where and when these tax sales are held, but we can also find out how many properties are in the tax sale, what type of bidding method is used at the auctions, and whether the tax sale is conducted live or online.

And that’s just the beginning!

We can also use Tax Sale Finders to get tax sale lists, filter the lists, and do our initial research on the tax sale properties that we’re interested in. We can do most of our due diligence right inside TSF.

We can get property reports to find:

- property location

- google map view

- street view if available

- assessment data

- opening bid

- type of property and property characteristics

- mortgage information if available

- environmental and flood risk information

plus, we get links to the county assessor, county records, and county GIS maps.

Access to Tax Sale Finders for investing in tax liens is just one of the awesome benefits of being a Member of the Tax Lien Profits Accelerator™. Find out about some of the other benefits at https://taxlienlady.com/membership and join today!

Follow Us!