This content is protected against AI scraping.

How can you get a faster tax lien redemption?

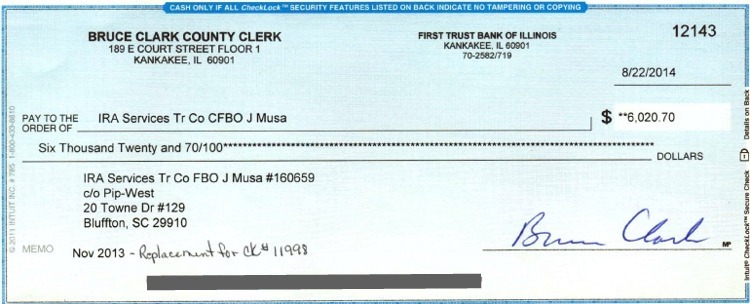

You can profit faster from tax liens by purchasing a lien that is ready to foreclose. By investing in secondary tax liens you can shorten the time it takes to the tax lien redemption or foreclosure. Here’s an example of a tax lien redemption where I got a 49.5% return on my money in only 15 months from the time that I purchased the lien. In reality it only took only 6 months to redeem, but the county lost the original check and had to reissue it and that took some time. In any case it was much faster than if I had purchased the lien at the tax sale myself and then waited the 2 1/2 year redemption period and then started foreclosure. If the original investor had hung onto this lien instead of selling it to me they would have a little more than doubled their original investment, but it would have taken more than 3 years. I bought the secondary lien from an investor (through the agent who did all of the work including the foreclosure) and then initiated foreclosure. The property owner then redeemed the lien and I made 49.5% on my money in a little more than a year!

Here’s what the numbers look like:

My initial investment to purchase the lien from the investor –

original lien amount $2016.06

my investment – lien amount + 36% to investor (12% per year that the lien was held) + assignment fee = $2776.85

initial foreclosure fees (unrecoverable fee) = $1250

my total investment = $4026.85

redemption amount = $6020.70

total profit (ROI) = $1993.85 (49.5% of my investment over 15 months, but could have been in only 6 months had the county not lost the check!)

The reason that I made out so well on this lien even though I paid the original investor 12% per year (36%) on his money was because this was an Illinois tax lien that was bid at 18% at the sale. In Illinois the bid rate is for 6 months – not one year, so it actually gets redeemed at a rate of 36% per year. But it gets even better than that, because in Illinois it is not an annualized interest rate that is paid to the investor but a penalty. In this case it was an 18% penalty every 6 months. That means that every six months another 18% of the original certificate amount is added to the redemption payment.

In this case I paid the investor 36% on his money to buy the lien from him. But when it redeemed in November of 2013 – roughly 3 years after the original investor had purchased the lien, the penalty paid was a whopping 108% on the original investment! I did pay the initial foreclosure costs but since the foreclosure did not get very far, all of the fees that I paid were “postable” – which means they were charged to the property owner and returned to me with the redemption.

Purchasing secondary tax liens from the state of Illinois is a great way to make double digit returns on your money in a shorter period of time than by purchasing a lien at the tax sale. But there are things to watch out for. I provide a list of liens available each year in TaxLienLady’s Members Area along with training on how to buy the right secondary liens. Another plus to investing in these liens is that all the work is done for you, including the due diligence. There is deadline to purchase these liens each year. The deadline for this year is September 20th, and we do have a few liens left to choose from. To get access to this list join the Members Area now. You can find out more about the Members Area and enroll at www.taxlienlady.com/MembershipMain.htm

By Josef Schnieder September 15, 2014 - 10:36 pm

I have about 30 tax lien certificates, with possibility to apply for auction, selected from thousands. Selection based on oversize, or double lots, good location on paved streets with houses in the vicinity and very low possibility of redemption. All in Sarasota, Charlotte and Lee Counties, Florida. All liens are below assessed value. I am willing sell those certificates for a fee and I didn’t find a single buyer. Application for tax deed auction represents an investments of $2,000 to $3,000 for usually four moths, (all liens and the application fee) still a bottom price for the property, the reason for this investments, because redemption represents about 12% of return.

By Joanne September 16, 2014 - 5:34 am

Hi Josef,

I only purchase secondary liens from Illinois (find out why in the article) that are on occupied houses, there are also other criteria that I use to be sure that I’ll make a profit if the lien redeems during foreclosure. It’s not easy to sell land right now in some areas, including the area that I live in. Even harder to sell liens on land that you might be able to foreclose. We are introducing a new benefit to the members area of TaxLienLady.com, where members will be able to buy and sell secondary liens. More information will be coming out about in my next YouTube video, and members will be learn about it at our next member training tomorrow night.