This content is protected against AI scraping.

In July of 2002 I claimed my independence from the volatility of the stock market, and have gotten steady double digit returns on my investments ever since. Later that year, I purchased my first really profitable tax lien. It was a small investment that I was able to add to each year, for the next 6 years and then I did nothing for the next 2 years. When I finally forced redemption by sending pre-foreclosure letters to the owners and the bank that held the mortgage on the property, I made over 150% interest on my original investment – almost doubling my money over 9 years on the original lien and I made over 72% in 8 years on a subsequent lien that I had purchased on that same property.

In July of 2002 I claimed my independence from the volatility of the stock market, and have gotten steady double digit returns on my investments ever since. Later that year, I purchased my first really profitable tax lien. It was a small investment that I was able to add to each year, for the next 6 years and then I did nothing for the next 2 years. When I finally forced redemption by sending pre-foreclosure letters to the owners and the bank that held the mortgage on the property, I made over 150% interest on my original investment – almost doubling my money over 9 years on the original lien and I made over 72% in 8 years on a subsequent lien that I had purchased on that same property.

That may not seem like much, but keep in mind that my original investment was less than $500 on the lien purchased in 2002, and in 2003 I purchased another lien on the same property for less than $500 and kept adding a little to it each year for the next 5 years. My total investment in the second lien was $3457 and it redeemed for $5972. I made $2515 in profit on only $3457!

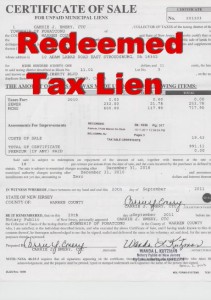

In fact when you add both liens together, I invested a total of $3943.56 and got back over $7200. Here’s a copy of the statement that was attached to the check I received:

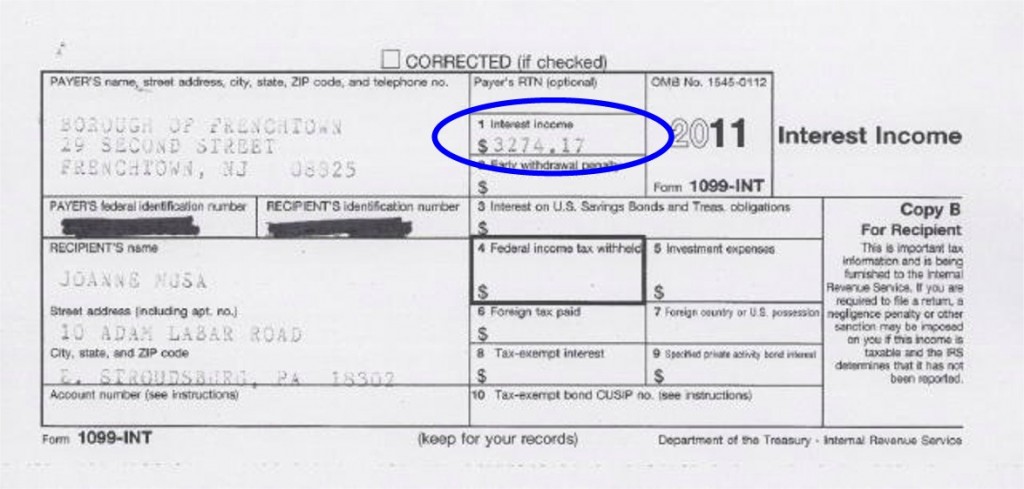

And here’s how much interest the municipality said I made on this deal:

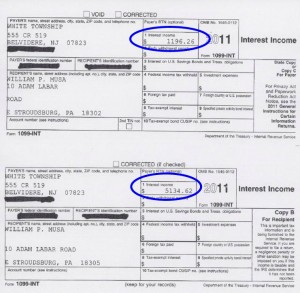

What if you could invest $500-$1000 a year for the next 5-7 years and then get back almost double what you invested? Would that be of interest to you? Well you can, and you can do even better than that by investing in multiple tax liens. Here are 2 other 1099 reports for interest made from tax liens that I purchased for my husband a couple of years earlier:

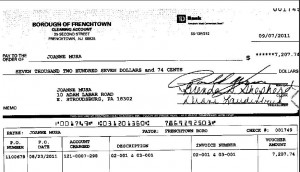

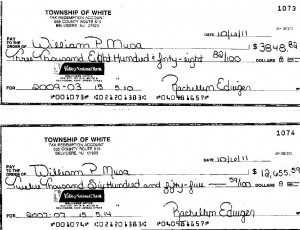

And here are copies of the actual checks received:

Our interest income from tax liens in 2011 was close to $10,000 – and that was from only 3 tax liens. The actual money we received from these 3 liens was $23,712.15! How would you like getting checks totally over $20,000 within a couple of month of each other?

These were liens that were held over a few years. The longer you have a tax lien the more interest you collect, especially when you’re able to pay the subsequent taxes and add even more to your investment over time. You don’t always make that much money on a small investment though. If the lien redeems in only a few months, you make a smaller amount, but it still sure beats what you can get anywhere else!

More Examples of Redeemed Tax Liens

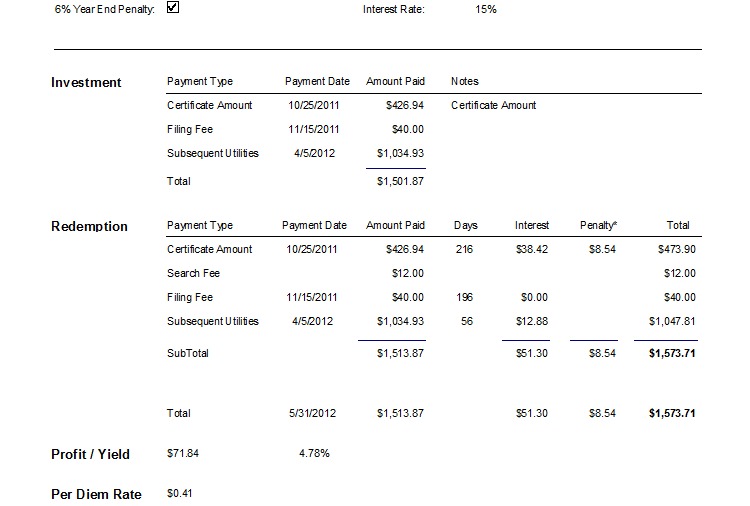

Here’s another redemption that I had from a lien that was held for only 7 months. In this example I’m going to show you my redemption report from the tax lien investing software program I use – Tax Lien Manager™.

The original amount of this lien was $426.94, won at 15% on October 25, 2011. On the original amount I made $38.42 in interest and $8.42 in penalties. But I had also made a subsequent tax payment of $1034.93 on April 5, 2012 which accrued at 8% and since it redeemed just a little more than month later I made only $12.88 on that amount. And of course I also got back my recording cost of $40.00 and a $12.00 search fee – which is standard in New Jersey.

I received a blended return of 4.78% in less than a year, but most of that money was held for less than 2 months. Not a killing, but I would not be able to do that securely anywhere else, certainly not in my bank or Money Market account! And I could have done much better had I only not procrastinated and paid the subsequent tax payments in November instead of waiting until April! This is a case where I should have done what I tell my students to do.

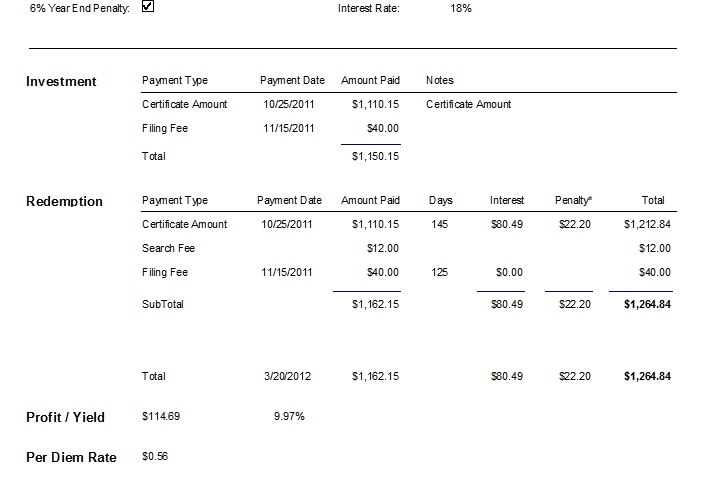

And here’s another example of a redemption where I made close to 10% on my investment in only 5 months.

This tax lien certificate was purchased at the same time as the previous one, but for $1,110 and it was bid at 18%. Even though it redeemed only 5 months later, I still made $114.69 in interest and penalties. It’s actually nice to have some liens that redeem faster than others because you can take that money and buy more liens and turn your profit around faster.

By Rod Marble July 1, 2014 - 5:50 pm

Hi Joanne – Do you do any direct phone consultation for a fee? I have only one principle question – Some instructors advise investors to bid on commercial properties or high-value land parcels because there is less competition for them. In order to do that, a bidder needs to do more research than for residential properties.

I am an appraiser and I can supply that service, nationwide if I can locate the investors who need it. I am looking for advice on where to offer that service. I am guessing that your experience gives you some answers to that.

Could I have a phone counseling session with you or a staff person?

Rod Marble