This content is protected against AI scraping.

Where is the best place to invest in tax lien certificates or tax deeds? Most people are concerned about which lien states have the highest interest rates and which deed states start bidding at back taxes. I believe that the best place to start investing is in your own backyard. I think that it’s best to invest in an area that you know, because you’ll know what the property values are and you’ll know what to look out for. Each state has different problems that you have to be aware of, especially if you’re purchasing raw land.

Where is the best place to invest in tax lien certificates or tax deeds? Most people are concerned about which lien states have the highest interest rates and which deed states start bidding at back taxes. I believe that the best place to start investing is in your own backyard. I think that it’s best to invest in an area that you know, because you’ll know what the property values are and you’ll know what to look out for. Each state has different problems that you have to be aware of, especially if you’re purchasing raw land.

In Pennsylvania where I invest in tax deeds, for example, I have to worry about whether a property will perk or not. If I buy a lot in a deed sale that doesn’t perk I won’t be able to get a septic design approved and won’t be able to build on the property. Its resale value will be a fraction of the price that I could get for it if it had an approved septic design. In another state you might have other concerns. In dry states, like Arizona for example, you may have to be concerned about water rights.

Don’t be too concerned about which state has the highest interest rate. In states with high interest rates, the interest is typically bid down extremely low. What you should be concerned about is will you have the opportunity to pay the subsequent taxes, and will you get the maximum interest rate on your subs, and are there other penalties that you are entitled to. In New Jersey, for example the interest rate is typically bid down to 0% and then premium can be bid as well. The reason that investors do this is because they know that once they have the lien, they can pay the subsequent taxes and get the maximum interest rate on their “subs,” which is 18%, and they will also receive a penalty on the certificate amount of the lien.

In Florida where the maximum interest rate is also 18%, the interest is typically bid down to as low as ¼ %. In Florida you do not get to pay any subsequent taxes, until the redemption period is over and you apply for the property to be sold in a deed sale to satisfy your lien. However, in Florida there is a minimum penalty of 5%, and in most counties if your interest adds up to less than 5%, you get the penalty the 5% penalty instead of the interest that you bid.

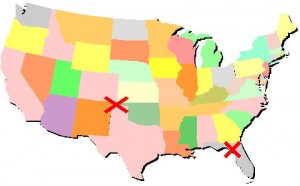

For tax deeds, don’t be too concerned about which deed states start bidding at back taxes. The more important thing to consider for deed sales is, “what will the competition typically bid the price up to.” In some states, real estate is so valuable and the demand outweighs the supply of affordable homes. In these states (California, Florida, and the Northeast States) any property with a home or business on it will be bid up close to market value. Remember, tax sales are auctions and sometimes people get carried away at actions and pay too much money. Online auctions can be especially competitive, and may California and Florida counties have their tax deed sales online.

To find out what the competition is like in tax sales in your county or municipality go to a tax sale and check it out. Talk to the tax collector, or whoever is responsible for conducting the tax sale in your area to find out more about how to register for the sale and what the procedures and requirements are for bidding. If you need help determining whom you need to contact, you can consult my State Guide. My State Guide is available as an e-book and comes with my Tax Lien Investing Basics home study course.

But what if you live in a deed state and you want to invest in tax liens?

I’m in Pennsylvania, which is a deed state, but I’m close to New Jersey, which is a lien state, so I do my tax lien investing there. If you’re not close enough to travel to a state that sell tax liens, is there a state that you vacation in or do business in that sell tax liens? If there is maybe you can write off your next vacation if you go to a tax sale? If not, then you may have no other alternative than to invest online. There are currently 9 tax lien states with at least one county or municipality that has online sales. These sales take place at various times throughout the year. Be very careful to do your due diligence on these properties. I don’t advise investing online unless you can go look at the properties or you have someone that can look at them for you.

Here are four action steps that you can take right now to find the best place for you to invest.

- 1. Call the tax collector and find out what happens in your state. Do they sell tax liens, tax deeds, or redeemable tax deeds?

- 2. Go to a sale and see what it’s like.

- 3. If you are in a deed state and you want to invest in tax liens, then find out what states sell tax liens, if you need help with this get my State Guide.

- 4. Find out about online tax deed sales at http://www.bid4assets.com. Bid4Assets has most of the online deed auctions for California as well as a couple of deed auctions for counties in other states.

If you take the action steps above, then you’ll have a good idea of what state is the best for you to invest in. And if you read my State Guide, you’ll have a good idea of what happens at tax sales in each state. If you need step-by-step information on how to get started, including how to find the best place to invest and where to get the tax sale information, you’ll want to get the Tax Lien Investing Program at http://TaxLienInvestingBasics.com.

Follow Us!