This content is protected against AI scraping.

Do you know how profitable your tax lien investing portfolio is?

Do you know how profitable your tax lien investing portfolio is?

In this article you’ll learn how to track your tax lien portfolio so that you know just how profitable you are at any time. Begin by entering all of your tax liens into a spreadsheet or software program. The best way to index them is by county/municipality, and tax ID (in New Jersey this would be block and lot). You’ll need a column or field for the certificate amount and a column or field to input the interest rate that you are getting on the certificate amount. For states where premium is bid, you’ll also need a column for any premium that was paid.

You’ll need to have a formula to calculate the penalty amount (in states that have a penalty) and a formula to calculate the interest due. These formulas must also take into account how many days have lapsed since you purchased the tax lien certificate. You may be able to ask the county treasurer for the formula that they use to calculate the redemption amount. You will also need to track any subsequent tax payments that you make and the interest due on your sub payments. And you will need a way to keep track of all of your expenses, both the expenses that are reimbursed upon redemption of the tax lien certificate and those that are not.

To calculate how profitable you are, take all the interest and penalties that are due both on the certificate amount and on any subsequent taxes paid. Add to this your original investment (the certificate amount) plus any subsequent taxes paid plus any expenses that are reimbursed upon redemption of the tax lien certificate. This is the total amount that you would be paid if your tax lien certificate redeemed. Subtract your total investment from this number. Your total investment is what you paid for your tax lien certificate plus any subsequent taxes that you paid plus any reimbursable expenses and non-reimbursable expenses related to your lien. This is your profit. Once you have your profit you can calculate the yield, or percent yield for each of your tax lien certificates. To do this, divide the profit by your total investment. If you want to convert this to an annual yield, you need to know how many days the lien was held for. Multiply the yield by 365 (the number of days in a year) and divide by the number of days that you held the certificate.

For instance if your profit was $360 on a tax lien that you held for 90 days and your total investment was $3600, your yield would be 10% and your annualized yield would be (.10 X 365) / 90 = .4055 or 40.5 %. You’ll need to do this for each tax lien in your portfolio. Then if you want to, you can get an average yield or annual yield for your entire portfolio.

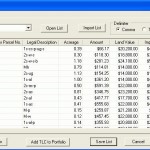

Since every state is different the calculations for penalties and interest will differ for each state and you will need a different spreadsheet or software for each state that you invest in. I use a software program that does all of this for me, and it’s customized for 6 tax lien states. It’s called Tax Lien Manager, and it does much more than calculate the profitability of your tax lien portfolio.

Tax Lien Manager will also calculate how much premium you can pay for tax liens and still be profitable and with Tax Lien Manager you can import standard and enhanced tax sale lists right into the program. Tax Lien Manager also provides you with all contact data for the state versions available? (Arizona, Florida, Indiana, Nassau County NY,and New Jersey, and South Carolina). Plus it comes loaded with the forms and letters you need for tax lien investing, like affidavits, pre-foreclosure letters, letters to send to the county clerk when recording your liens and more. You can find out more about Tax Lien Manager at www.taxlienlady.com/TLM/mainpage.htm.

The calculation in the example in this article is just a crude calculation and does not take into account certain factors, like how many days your subsequent tax payments are held, but there are other calculations in Tax Lien Manager that are more accurate, and it also calculates Internal Rate of Return and Cash on Cash Return for your current liens.

What method do you use to calculate your profitability, and manage your tax lien portfolio?

Follow Us!