![]()

![]()

![]()

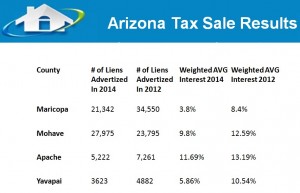

Arizona is one of the most popular states for online tax sales. Here are the results of some of the Arizona online tax lien sales.

Arizona is one of the most popular states for online tax sales. Here are the results of some of the Arizona online tax lien sales.

Maricopa county is one of the largest and heavily attended online tax sales with over 40,000 liens advertised for sale in their 2010 tax sale. but the number of liens available at the tax sale has been dwindling down each year since, and this year there were only about half as many advertised certificates as there were in 2010. The weighted average for the winning bid for all batches was 8.6% in 2010 and only 3.8% for this year. Some bids were won at 0%, which doesn’t make any sense, since you only get what you bid at the sale on your subsequent tax payments, and Arizona doesn’t have pay any other penalties that I am aware of. Although some counties enforced a “Single Simultaneous Bidding Entity Rule,” which prevented entities from bidding multiple times or even spouses bidding in the same tax sale if they filed a joint tax return, Maricopa did not enforce such a rule. One institutional buyer in particular – Redfield Funding LLC, took up a large portion of bidder numbers.

Apache County has a much smaller online tax sale with only one third the amount of advertised liens as Maricopa and even fewer bidders. The weighted average winning bid was much higher than in Maricopa – over 11%. Mohave County had a few more advertised liens for sale than Maricopa, but not as many bidders. The weighted average winning bid in Mohave for all batches was a little over 9.8%.

Pinal, Coconino, and Yavapai Counties also held online tax sales. All three of these counties enforced the Single Simultaneous Bidding Entity Rule, in the hope that it would even the playing field between all of the institutional buyers and individual investors. You have pay very close attention to this rule because not only does it prevent entities from registering multiple bidding number it also prevents spouses from bidding at the same tax sale if they file a joint tax return and it prevents someone from bidding in a business name and his or her own name. Coconino and Pinal do not have their tax sale readily available online but Yavapai County does. Yavapai County had less than 4000 properties advertised in the tax sale and just a little over 2500 sold. There were 39 certificates sold at 0% and 351 sold at 16%. The average interest rate was 7.69% and the weighted average interest rate was 5.86%.

Online Investing Trends and Stealth Strategies for Making Money in Today’s Market

Recently I did a webinar where I went over the results of the online tax sales this previous year in Iowa, New Jersey and Arizona. The name of the training is “Tax Lien Investing Is Dead…. And What You Can Do About It!” In this special training I gave 3 of my stealth strategies for double digit returns in today’s market. And I gave the details of how one of my coaching clients made 30% on his money in 9 months with a tax lien. Learn all about these stealth strategies for investing in the replay of this exclusive webinar training that I did for TaxLienLady Members and coaching clients for only $9.95! Get access to the replay now at www.TaxLienLady.com/webinar-training.

Follow Us!