When it comes to your tax lien investing what is it that you have more of – time or money?

Have money but no time?

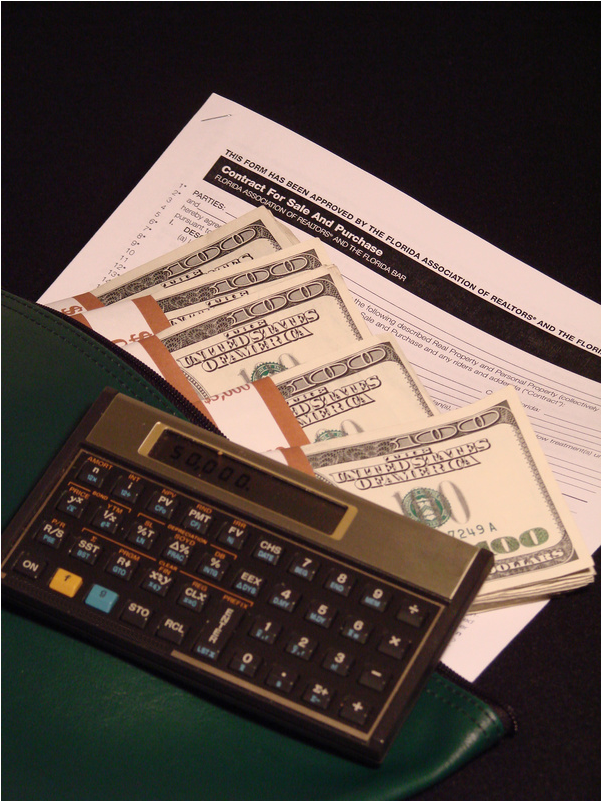

Some investors have plenty of money to invest in tax lien certificates and/or tax deeds, but they don’t have the time to do the due diligence and bid at the tax sales. If you’re short on time but you have a substantial amount of money to invest then you might want to use a tax lien agent or a tax lien investing fund to do the work for you.

Agents and fund manager are experts at purchasing and managing profitable tax liens and tax deeds for their clients. They have a competitive edge that as an individual investor, you don’t have, and they have a better chance of getting profitable liens than you do. By using a tax lien agent or investing in a tax lien fund you don’t just take care of your problem of not having enough time to do the work; you also manage to be more competitive. This also solves the problem of having to travel if you don’t live in the state that you want to invest in. For instance if you live in California, which is a deed state but you want to invest in tax liens, that could be a problem if you’re doing it yourself.

Got the time but not much money?

If you don’t have a big chunk of money to invest, but you have some time to do the work, you can start investing in tax liens with as little as $500. You just need to be able to have the time to go to tax sales and to do the due diligence necessary to ensure that you buy profitable tax liens. You can make decent profits with small tax liens; it will just take you longer to get enough money invested to where you are seeing decent redemption checks.

When I started investing back in 2002 I purchased one of my first small liens, it was a utility lien just under $500. In some states delinquent utilities owed to the town or county are sold at tax sales. This lien was for sewer charges and each year thereafter I was able to pay the subsequent sewer charges. The mortgage company paid the taxes, but the owners of the property never paid the sewer charges. Since in this state a tax lien does not expire for 20 years, I let this go on for a few years. Finally in 2011 – 9 years after I first purchased the lien, I forced redemption by sending a pre-foreclosure letter to the property owner and lien holders.

The mortgage company paid off the lien to the tune of over $7,201.74. Now this was not all profit, I had paid in $3919.56 over the course of 6 years (I made my last payment in 2008 and then did nothing for 3 years), $3282.18 was profit from interest and penalties. I almost doubled my money in 9 years starting with less than $500 and investing a total of under $4000 over 6 years, and then waiting 3 more years to collect my interest – you just can’t do that in the bank!

By Miss Harris November 18, 2011 - 8:01 pm

What is the minimum amount of money needed for using a tax lien agent or investing in a tax lien fund?

By Joanne November 21, 2011 - 4:20 pm

Hi Miss Harris,

You need a minumim of $20,000 for investing with the tax lien agent PIP-West and $25,000 for investing with Comian tax lien fund. Using an agent or fund is something that you do when you don’t have the time but you do have a good amount of money to invest.

By Joanne D November 16, 2011 - 3:31 pm

Two questions:

The pre-foreclosure letter that you sent, was this something your lawyer drafted or just something you drafted?

Why did you stop paying after 2008?

Thanks!

By Joanne November 18, 2011 - 10:25 am

Hi Joanne,

This was in response to a letter that I sent, this letter is included in the TaxLienManager software program for NJ.

I stopped paying because I new that was going to send a letter and force payment. I actually sent letter in 2009 and 2010, but I didn’t get any response because I was only sending the letter to the owner of the property and not the mortgage holder. I got a response as soon as I sent the letter to the mortgage holder. It was the mortgage company that redeemed the lien.